Charting Your Course: 10 Financial Rules for Pilots to Navigate Financial Planning

Here are some rules to follow allowing you to chart your course in the most efficient way possible.

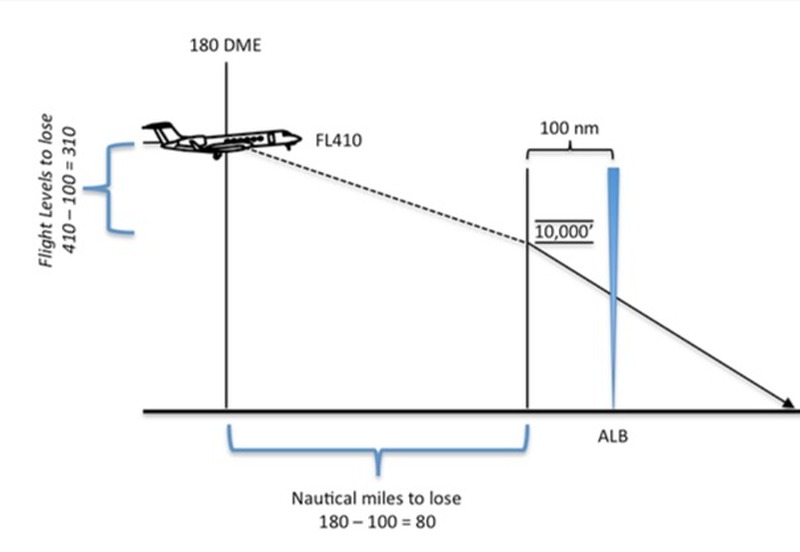

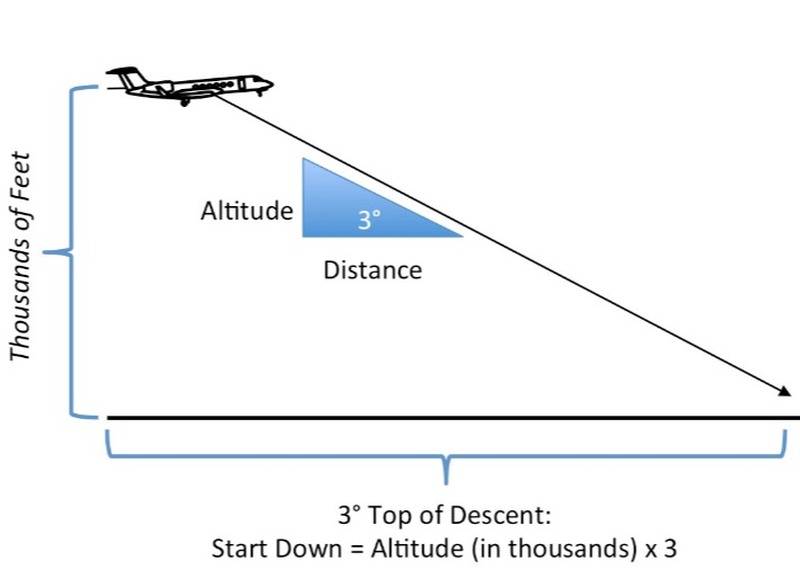

The 3:1 Descent Rule

The 3:1 Descent Rule adapted for Financial Planning

Just as pilots use the 3:1 rule to plan a smooth descent, you can apply a similar principle to your financial goals. For every financial milestone, plan ahead by breaking it into manageable steps:

• Three parts preparation for every one part execution: Allocate ample time to build savings, investments, or emergency funds before taking big financial steps, such as buying a home or retiring.

• Start early to avoid steep descents: Just like initiating a descent too late can lead to a rough landing, delaying financial planning can create unnecessary stress.

By preparing early and taking deliberate actions, you can ensure a smooth transition toward your financial goals—just like a well-executed descent into your destination.

The 10,000 Foot Rule

The 10,000-Foot Rule adapted for Financial Planning

Just as the 10,000-foot rule in aviation requires focus and discipline during critical phases of flight, financial planning has its own “sterile cockpit” moments:

• Stay focused during key financial transitions: Whether you’re paying off debt, saving for retirement, or navigating a career change, minimize distractions and focus solely on the task at hand.

• Avoid unnecessary risks or impulsive decisions: Just as pilots avoid non-essential conversations below 10,000 feet, maintain financial discipline by sticking to your plan during pivotal moments.

• Prioritize your goals: At lower altitudes, pilots prioritize safety. Similarly, prioritize essentials like emergency funds, debt repayment, and retirement savings over less critical expenses.

By applying this principle, you can ensure a safe, steady approach to your financial goals, even during high-pressure situations.

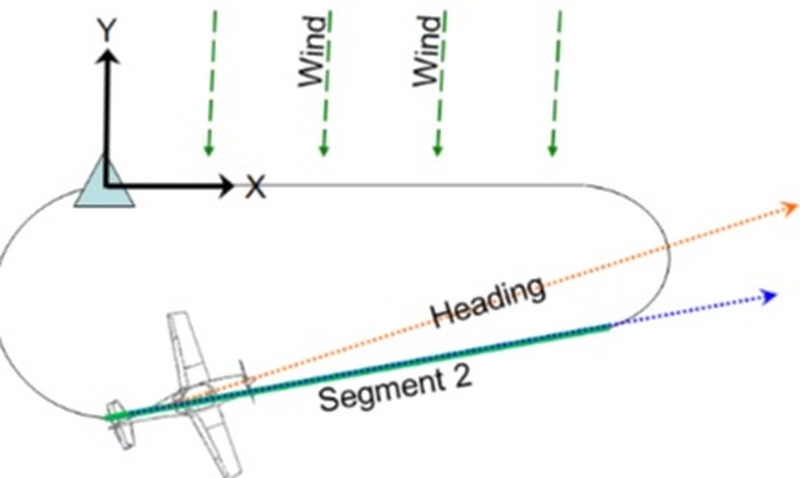

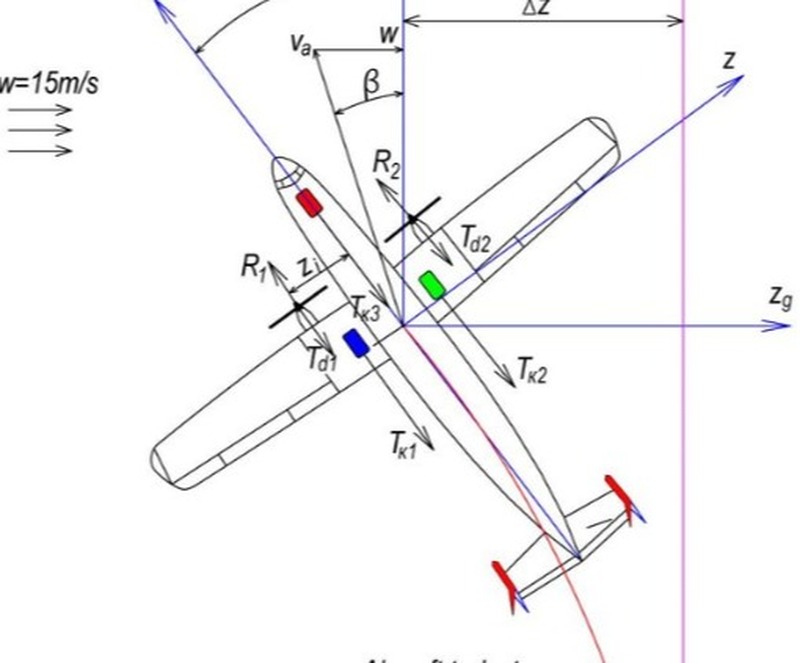

The Wind Correction Rule

The Wind Correction Rule adapted for Financial Planning

Just as pilots adjust their heading to compensate for crosswinds and stay on course, financial planning requires constant adjustments to account for external factors:

• Identify financial “crosswinds”: Market fluctuations, unexpected expenses, or changes in income can push you off course.

• Make small, calculated adjustments: Like pilots fine-tune their heading, review your budget, investments, and goals regularly to ensure you’re aligned with your financial destination.

• Stay proactive, not reactive: Anticipating challenges and planning ahead keeps you on track, just as correcting for wind before it becomes a problem ensures a smooth flight.

By compensating for life’s financial “winds,” you can maintain your course toward long-term stability and success.

The 1% Groundspeed Rule

The 1% Groundspeed Rule adapted for Financial Planning

In aviation, the 1% groundspeed rule helps pilots determine a smooth descent rate. In financial planning, this principle can guide steady progress toward your goals:

• Calculate sustainable steps: For every major financial goal, determine the “1% rate”—a manageable, consistent contribution or adjustment that aligns with your income and resources.

• Avoid steep descents: Just as a rapid descent can cause discomfort, drastic financial changes (like cutting expenses too quickly) can lead to stress and unsustainable habits.

• Keep pace with your journey: Align your financial progress with your current “speed” in life, whether you’re early in your career, mid-flight, or nearing retirement.

By applying small, steady adjustments, you can ensure a smooth financial transition without unnecessary turbulence.

The 5-Ts Rule

The 5-Ts of Aviation adapted for Financial Planning

Just like the 5-Ts guide pilots at navigation fixes, they can serve as a checklist for staying on track with your financial journey:

1. Turn: Adjust your financial “heading” by reviewing and realigning your goals as life circumstances change (e.g., career shifts, family needs).

2. Time: Set clear timelines for each financial milestone, such as saving for a down payment or building an emergency fund.

3. Twist: Fine-tune your financial instruments, such as updating investment allocations, adjusting retirement contributions, or optimizing tax strategies.

4. Throttle: Regulate your financial “power” by controlling spending, increasing savings, or boosting income when necessary to stay on course.

5. Talk: Communicate with your financial advisor, spouse, or accountability partner to ensure clarity and support in achieving your objectives.

By following these steps, you can navigate financial challenges with the same precision and confidence as a pilot managing navigation fixes.

The 60-Second Rule

The 60-Second Rule adapted for Financial Planning

In aviation, the 60-second rule for IFR holding reminds pilots to pause, orient themselves, and regain focus when things feel overwhelming. In financial planning, a similar approach can help during uncertain times:

• Pause and assess: When faced with financial uncertainty—like unexpected expenses or market downturns—take a moment to review your situation instead of reacting impulsively.

• Prioritize key actions: Just as pilots focus on “Aviate, Navigate, Communicate,” prioritize your financial essentials:

• Aviate: Keep your day-to-day financial operations stable (e.g., paying bills, managing expenses).

• Navigate: Reassess your financial plan and adjust as needed to stay aligned with your long-term goals.

• Communicate: Consult with your financial advisor or trusted resources for guidance.

• Stay calm under pressure: A short pause to refocus can prevent costly mistakes and ensure smoother decision-making.

By applying this rule, you can regain control and confidence during financial turbulence, ensuring you stay on course toward your goals.

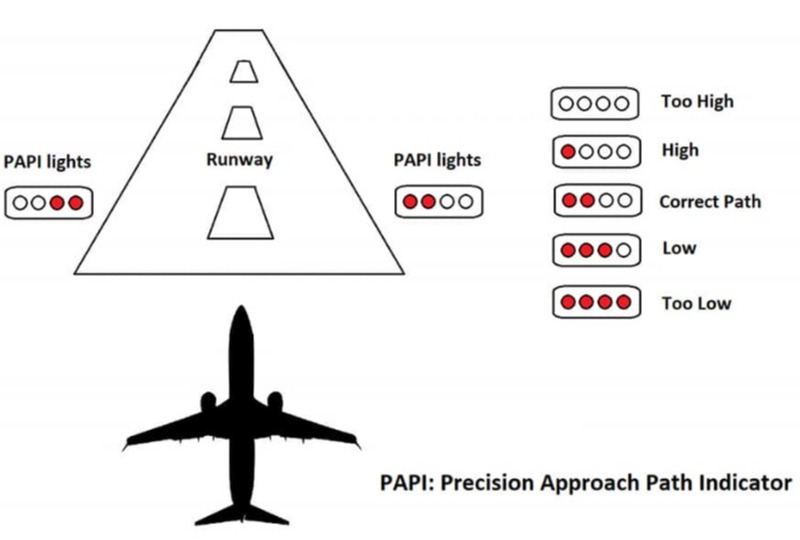

The 3-Degree Glide Slope Rule

The 3-Degree Glide Slope Rule adapted for Financial Planning

In aviation, the 3-degree glide slope ensures a smooth and controlled descent toward the runway. Similarly, this principle can guide you to approach your financial goals steadily and sustainably:

• Plan gradual progress: Approach financial milestones, such as retirement or debt repayment, at a steady, manageable pace. Avoid “steep descents” like extreme budget cuts or risky investments.

• Maintain alignment: Like staying on the glide slope, regularly check your progress to ensure you’re on track with your financial plan. Small adjustments can prevent larger corrections later.

• Calculate the path: For large goals, break them into smaller, measurable steps. For example, if you need $100,000 in 10 years, calculate your annual savings target and stick to it, just as pilots follow altitude checkpoints.

• Ensure a smooth landing: By approaching your goals methodically, you reduce financial stress and improve your chances of reaching them successfully.

This rule emphasizes that steady, consistent actions will lead to a stable financial “landing,” whether that’s achieving financial freedom or retiring comfortably.

The 1-2-3 Fueling Rule

The 1-2-3 Rule adapted for Financial Planning

In aviation, the 1-2-3 rule for fueling ensures that pilots have enough fuel to reach their destination, an alternate airport, and an additional reserve. Similarly, applying this principle to financial planning can help ensure you’re prepared for all financial contingencies:

1. Destination: Ensure you have enough funds for your primary financial goals, whether it’s saving for retirement, a home, or education.

2. Alternate: Set aside money for an emergency fund or alternative goals (such as paying off unexpected medical expenses or handling job loss).

3. Reserve: Build a financial cushion for unforeseen circumstances, like market downturns, urgent repairs, or opportunities that require quick action.

By applying the 1-2-3 rule to your financial strategy, you can ensure you’re prepared for both expected and unexpected events, making your financial journey more secure and resilient.

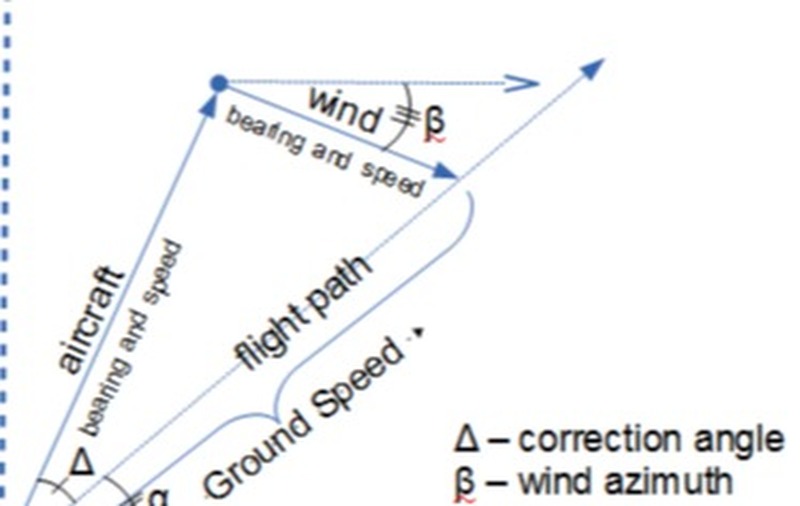

The Drift Angle Rule

The Drift Angle Rule adapted for Financial Planning

In aviation, the drift angle rule helps pilots compensate for wind and stay on course. Similarly, in financial planning, this principle can help you adjust your approach when external factors push you off track:

• Recognize external “winds”: Just as pilots account for wind when navigating, be aware of external factors like market volatility, changes in income, or unexpected expenses that can affect your financial path.

• Make small, strategic adjustments: Rather than making drastic changes to your plan, make small adjustments to your budget, investments, or savings contributions to stay aligned with your long-term financial goals.

• Regularly reassess your course: Check your financial “heading” periodically to ensure you’re still on track, adjusting for life changes or economic shifts, much like pilots continually reassess their heading to account for wind direction.

By applying the drift angle rule, you can maintain financial stability and stay focused on your goals, even when life’s “winds” try to push you off course.

The 4:1 Rule for Visual Approaches

The 4:1 Rule adapted for Financial Planning

In aviation, the 4:1 rule for visual approaches helps pilots maintain a smooth, controlled descent. In financial planning, this principle can guide you toward a steady and successful path to your financial goals:

• Align your descent with your financial goals: Just as pilots aim for a 4:1 ratio when planning their descent, apply a similar ratio to your financial savings. For example, for every $1,000 of financial goal, aim to save $250 each month, adjusting as necessary based on your overall financial situation.

• Maintain consistent progress: The 4:1 rule keeps pilots on track, just as consistent, incremental progress helps you avoid large setbacks. Break large financial goals (like retirement or homeownership) into smaller, manageable steps to keep yourself on course.

• Ensure a smooth transition: Just as pilots adjust their rate of descent for a smooth landing, you should adjust your spending and saving to ensure a smooth transition toward reaching your financial goals, avoiding sudden or drastic changes that could derail progress.

By applying the 4:1 rule to your financial planning, you can ensure a steady and manageable path toward your destination, with a smooth “landing” when you reach your financial goals.