PARRIS FINANCIAL

Parris Financial

Noah R Parris

Wealth Management Advisor|CPWA®, CFP®, MBA, ChFC®, RICP®

Working with individuals receiving stock compensation, business owners, and high-net worth families

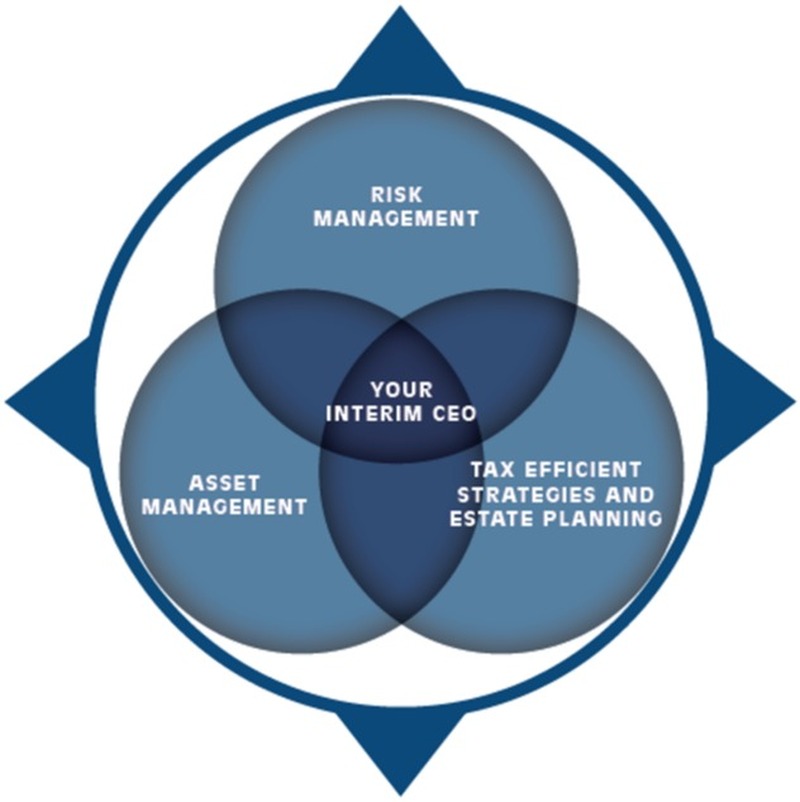

Your Interim CEO

Our aim is to craft a unified blueprint and strategy combining risk, assets, tax efficient strategies and estate planning all in helping to maximize benefits for you and your loved ones. Our goal: guide clients to age 100, easing financial concerns, reducing taxes, and enabling them to shape their legacy precisely as desired.

Envision yourself as the Owner and CEO of your own hypothetical “Personal Wealth Company,” overseeing all operations. We step in as your “interim CEO” to that harmonizes these complex and personalized aspects.

Our Planning Process

- Review your Values, Vision & Goals

We will look at your current mindset, beliefs, and understanding towards wealth-building. Review the progress you have already made in your current wealth picture. - Work your Strategic Plan

Brainstorm strategies and tactics with our team and then craft the most appropriate plan on your behalf. We will present and discuss with you your custom financial blueprint. - Implementation

Put together individualized timeframe and take action on your financial gameplan. - Careful Monitoring

Our team will regularly evaluate performance and make necessary corrections. We will communicate with you regularly about performance and meet annually or sooner if conditions require it.

Why clients choose Parris Financial

Our financial conversations don’t begin with your finances. Instead, we start with you - your life, your family, your priorities, and goals. Once we have your big picture in focus, we’ll tailor a plan from a range of financial options using multiple strategies designed specifically to help you get to where you want to be.

Coaching

We find that clients are busy and need experts in their life. We aim to GUIDE them in their journey through:

- Behavioral coaching

- Budget coaching

- Accountability

- Employer benefits

- General Q&A

Comprehensive Planning

Parris Financial quantifies our clients' goals and tracks them. We help our clients to be highly tax-strategic and tax aware. This helps our clients define their financial capacity so that they don’t underspend or get overtaxed in retirement.

Performance

We aim for better long-term performance than what a client can do on their own and to ensure their planning goals can be achieved. Investment performance, while critically important, is not where we start. It’s secondary to the fact of being able to achieve one’s goals for life! If we’re focused on process, which we are, and on excellence, which we are, the overall financial plan performance tends to take care of itself. (Although we take every step we can to help ensure our client’s success, all investments carry some level of risk, including loss of principal invested.)

Protection

We believe in integrating risk management/insurance tools to help optimize our clients’ outcomes. If we can participate in the performance and profitability of excellently run risk management partners and we can minimize the cost of those risk management tools through the years, that is a huge advantage for our clients – while taking on lesser risks.