Navigating Your future with confidence

W Mason Curran II

Wealth Management Advisor|CLU®, ChFC®

Tailored Strategies for Your Financial Journey

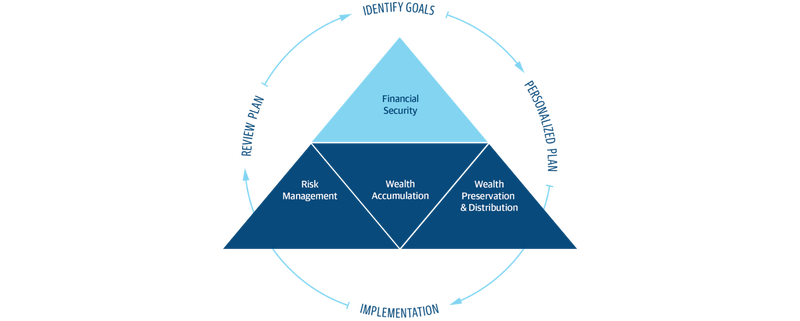

At Team Curran, our first step is to understand your current financial position, regardless of where you may be starting from. Once we have a clear picture, we will develop a customized set of strategies exclusively designed to guide you towards your desired destination. Our collaborative approach ensures that every aspect of your financial journey is tailored to your specific goals and aspirations. Together, we will navigate through various options, exploring different paths that align with your vision for the future. Rest assured, our dedicated team will be by your side every step of the way, providing the guidance and support you need to achieve your financial objectives.

Look at where you are today

Your plan will help you make the most of what you already have, no matter where you're starting from, and give you a snapshot of your financial big picture.

Identify where you want to go

Whether it's shorter-term goals like managing your debt, or longer-term ones like saving for a new home, or retirement, your financial plan will show you how you're tracking, help you understand what's working, and point out any gaps you might have.

Put together range of options to get you there

Looking across all your goals, you'll get personalized recommendations and strategies to grow your wealth while making sure everything's protected. And I'll help you determine the right moves to make today and later on. Your financial plan is based on your priorities. As those priorities change throughout your life, we'll shift the financial strategies in your plan, too-so your plan stays flexible, and you stay on track to consistently meet goal after goal.

Retirement planning

We tailor your plan to fit you and your goals with a range of financial options. From insurance for protection to strategies for growing your money and providing more flexibility, we'll help you live the retirement you always wanted.

Estate planning

We can help you coordinate with your other advisors like attorneys, accountants, and tax professionals to do things like set up trusts, minimize taxes, and administrative costs that can protect the legacy you leave behind.

Education funding

With the cost of school continuing to rise, it's more important than ever to have a plan to pay for it. From strategies for saving and funding education to how whole life insurance can play a role, we can help you understand your options.

Business planning

No matter if your business is big or small, we'll work hard to help you grow. From protecting against risk and managing growth, to attracting and retaining top talent, we have a range of solutions designed for you and your employees.