Mark Alan Van Wagenen

Wealth Management Advisor|ChFC®

Get a Financial Plan That Prioritizes Your Priorities.

Together, we'll look at where you are, wherever that is. I'll then give you multiple strategies specifically designed to take you where you want to go. Here's how we'll get it done:

Look at where you are today

Your plan will help you make the most of what you already have, no matter where you're starting from, and give you a snapshot of your financial big picture.

Identify where you want to go

Whether it's shorter-term goals like managing your debt, or longer-term ones like saving for a new home, or retirement, your financial plan will show you how you're tracking, help you understand what's working, and point out any gaps you might have.

Put together range of options to get you there

Looking across all your goals, you'll get personalized recommendations and strategies to grow your wealth while making sure everything's protected. And I'll help you determine the right moves to make today and later on. Your financial plan is based on your priorities. As those priorities change throughout your life, we'll shift the financial strategies in your plan, too-so your plan stays flexible, and you stay on track to consistently meet goal after goal.

Of course, our role with clients goes beyond just providing expert guidance in the creation of your financial plan. When we work with you during a fee-based financial planning engagement, we follow the fiduciary standard which means that we act in your best interest and put your interests ahead of ours. We'll also help you implement your plan through a combination of innovative investment and insurance solutions.

In the end, we are paid to work with you to make sure your financial needs are met with care, with expertise and with an understanding of your unique circumstances and individual goals. Together, we can agree on the appropriate fee structure based upon those needs and the specific services required.

Making great decisions about your wealth, whether you are deciding to grow it or protect it or both, starts with sound thinking; thinking that makes sense. Here’s how our thinking starts when it comes to helping you make important financial decisions.

With financial independence, family legacy and social capital solutions in place, wealth optimization becomes the focus of the planning process. We use a unique and disciplined values-based approach to help you make wise choices and to help ensure that your plan is focusing on what you value.

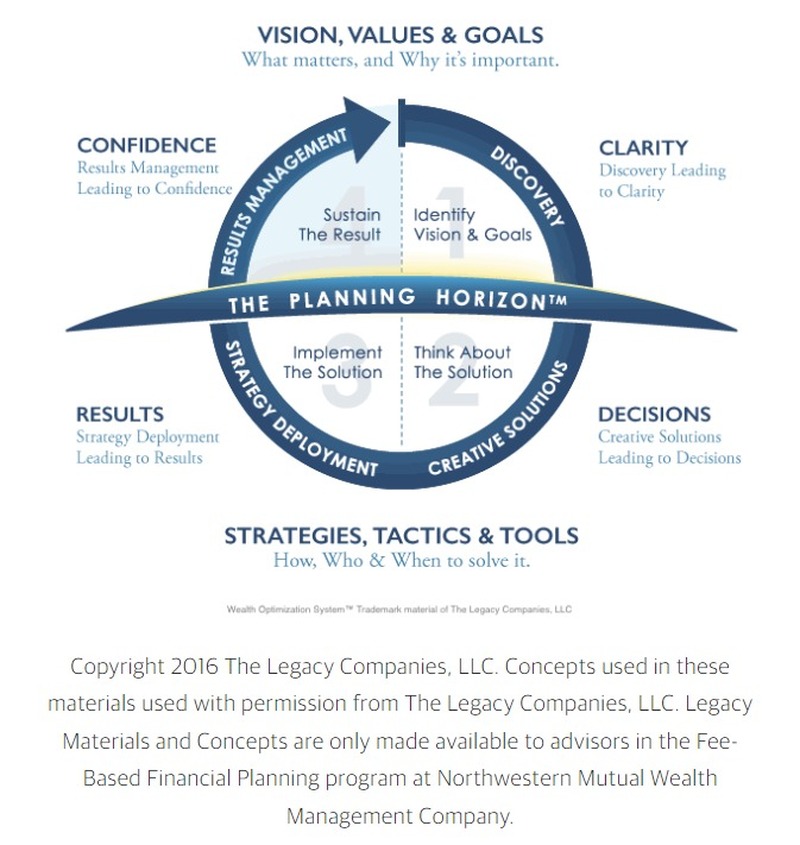

We break the planning process into four quadrants or phases, each one representing one planning cycle:

- Discovery: Identify and think about the problem

The first phase begins by thinking clearly about the problem. This is called the Discovery phase and this is where clarity is achieved around your goals and planning gaps are identified.

- Creative Solutions: Think about the solution

The second phase is the Creative Solutions phase where you think clearly about the solutions and make decisions regarding closing the planning gaps.

- Strategy Deployment: Implement the solution

The third phase is the Strategy Deployment phase where you implement the solution and help achieve your desired results.

- Results Management: Manage the results

The final phase is the Results Management phase where we establish a plan to manage and implement the results. This assures you have confidence your plan will work over time.

Working with a knowledgeable and experienced planner who has access to current technologies and a thorough understanding of tax rules and financial planning techniques is important. Working with an advisor who takes the time to understand your unique desires and goals is critical.

We will take the time to help you make that assessment, develop a plan that works for you, and provide you with the tools and strategies necessary to successfully implement that plan.

Values-Based Planning

Discovery Leads to Wise Choices

You have individual experiences and unique hopes and dreams that call for a values-based approach to financial planning. Your core values become the basis for defining your financial philosophy and this serves as a guide in developing your plan.

The starting point for Financial Discovery is to separate two conversations that are often blended into one. Specifically, planning conversations can sometimes move too quickly to solutions, before taking the time to really understand what matters to you, and why it matters.

To address this, we separate the conversations using a concept called The Planning Horizon™. First we explore what matters and why. Once we do, then we’ll work with you to develop a plan to achieve it.

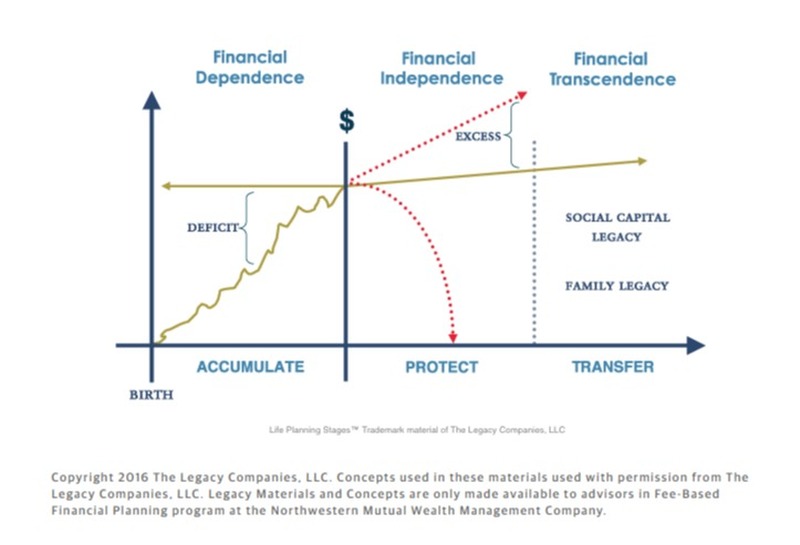

Natural Priority of Wealth Planning

The wealth planning process often involves three phases: financial independence, family legacy, and social capital.

- Financial Independence:

Solutions are in place to meet your retirement and other personal goals to ensure your personal financial well-being.

- Family Legacy:

Leaving your children an inheritance, giving them a financial head start in life and providing for their general future needs along with your personal values will shape the commitments you make in creating your family legacy.

- Social Capital:

Determining the disposition of your assets through community and charitable giving take place to ensure your assets will not go to the government in the form of a tax but to a charity as a gift.

Your plan should maintain your desired lifestyle and protect your financial security, transfer what you have to whom you want, when you want and how you want, and allow you to choose between charitable or tax dollars.

Investment Strategies

Your goal to achieve financial security will undoubtedly include investing for your future.

We can offer you the expertise you need to ensure your investment strategy is aligned with your goals, time horizon and tolerance for risk.

Through resources on our team and within the Northwestern Mutual, we can also help you choose an asset allocation strategy and build a custom portfolio tailored to your financial goals.

You'll benefit from:

- Personalized asset allocation

- Professional research

- Flexible, high-quality investment options

- Portfolio rebalancing to maintain your asset allocation

- A simplified, integrated approach

During regular portfolio reviews, you'll have the opportunity to reassess your goals and rebalance your portfolio accordingly.

Risk Management Solutions

When your financial plan includes wealth protection and risk management, you'll be helping to ensure your family - and your vision for the future - is secure.

We'll work with you to develop strategies to:

- Provide for your family in the event of death.

Life insurance policies can be designed with different needs in mind. They can provide temporary protection, cash accumulation or may be utilized as part of an estate plan. Through our association with Northwestern Mutual, we have access to Northwestern Mutual's high-quality, competitively priced life insurance products, including permanent, term, combination and variable policies.

- Provide for you and your family in the event of a disability.

Disability income insurance helps to protect your most valuable asset, your ability to earn an income. But what if the unexpected happened and you suddenly weren’t able to earn a living because of illness or injury? Not only would you have the stress of meeting everyday living expenses, but you might also have to put other goals, like saving for a child's college or for retirement, on hold.

- Provide for long-term care.

Long-term care events can have a significant impact on your financial security. Planning for long-term care events can help provide options on how to fund and receive care, should you need it.

Retirement Planning

Now more than ever, planning for your retirement is critical. Gone are the days when pensions and Social Security provided all of the income you needed for retirement. The new reality is that you are responsible for managing your own retirement, and that starts with making sure you’re strategic in your planning.

We can help. At Northwestern Mutual, our approach to retirement planning is designed to help you get to – and through – retirement with a greater level of financial confidence, so you can relax knowing you have a road map to achieve your goals.

You’ll want to start by considering how much to save for retirement and where to save it. By accumulating as much as you can as soon as you can, you can put time on your side – time to plan, time to weather the ups and downs of the market and time to let your money grow. Learn more about saving for retirement on Northwestern Mutual’s website, or download our white paper “Retirement Saving: 5 Key Insights You Need to Know.”

And then, as you zero in on retirement, you’ll need a different set of strategies to manage risk and make your money last through retirement. Learn more about turning your money into a steady stream of retirement income in our two-minute video Getting to and Through Retirement, or on the Northwestern Mutual website you can learn about strategies to optimize your retirement income as you approach retirement.

Estate Planning

Most people associate the phrase "estate planning" with having a will - a legal document that names your beneficiaries and spells out who gets what when you die. And while the transfer of your assets is an important part of estate planning, a will or a trust is just one aspect of broader estate-planning strategy to ensure your wishes are known, honored and carried out as efficiently as possible when you're no longer able to articulate them.

We work with a team of estate-planning experts at Northwestern Mutual. Together, we can help you develop an estate planning strategy that may include the following:

- A strategy to reduce or eliminate gift/estate taxes for your heirs

- A plan to protect your estate from mismanagement or from claims of creditors or ex-spouses

In addition to the expertise our team can offer, you'll want to work with an estate-planning attorney to establish:

- Health care directives or a living will that specifies the extent to which you want health care professionals to treat you if you become ill or incapacitated

- Powers of attorney that grant people you trust the legal authority to act on your behalf in case of sudden accident or illness

- A will or trust to ensure your assets are transferred according to your wishes

- The naming of a legal guardian for children under the age of 18

Education Funding

If one of your financial goals is to pay for a child’s education, the earlier you establish a college savings plan the better. Not only will you save more, you’ll have more time to ride the ups and downs of the financial markets if you choose to invest your savings.

Two of the most common college funding vehicles are 529 Plans and Coverdell Education Savings Accounts, though there are many ways to save for a child's education. To learn more about the options - the pros, cons and tax advantages of each - download our white paper: “Saving for College with Confidence: Your Guide to Education Funding .”

And although your wish may be to fully fund your child's education, don't allow that goal to put your own retirement at risk. If you don't take care of funding your own retirement, you may end up weighing down your kids with that responsibility later in life.

Children have options for funding their education such as loans and scholarships. Retirees don't.

Working together on your financial plan, we can help you better understand your options to meet all of your financial goals.

Business Planning

Whether you're thinking about launching a new business or planning to expand an existing one, our team can help you create, grow and protect your business's value.

We'll work with you to develop a personalized financial plan with solutions designed to meet the unique needs of your business, with strategies to:

- Integrate all aspects of financial planning for your business and your personal life to ensure success on both fronts.

- Help minimize risk by being prepared for the unexpected.

- Safeguard your business with coverage to help offset the loss of cash flow if you become sick or hurt.

- Recruit and retain employees with competitive benefits programs, including fee-based financial planning services.

- Enhance your benefits programs to reward employees who are key to the success of your business.

- Transition your business smoothly with a properly designed and funded business succession plan.

Employee Benefits

One of the biggest challenges faced by business owners today is the need to recruit, retain and reward talented employees. A well-designed benefits package can give you a competitive advantage in the war for talent.

Our team can help you design a quality, affordable benefit plan that may include features such as:

- Group health insurance.

- Group life insurance.

- Group disability income insurance.

- Dental insurance.

- Vision insurance.

- Flexible spending accounts.

- Qualified retirement plans such as SEP IRA or 401(k) plans.

Learn more about how our team of specialists can help you design a competitive package that can attract and retain top talent.

Executive Benefits

As a business owner, it's important to recognize the dedication and commitment of your most important contributors.

We can help you design an executive benefits package that provides additional compensation to selected employees, which may include:

- A supplemental executive retirement plan which allows you to promise to pay additional income to yourself or your key employees at a later date, which is usually retirement.

- An executive deferred compensation plan which allows you or your key employees to forego receipt of a portion of current income until a later date, which is usually retirement.

- Bonus plans which provide you or your key employees with additional income that can be used to purchase insurance, annuity or investment products.

- Fee-based financial planning which includes providing expert financial planning guidance to key employees, plus assistance in implementing their individual plans through innovative brokerage or advisory product solutions.