article

The Millennial’s Guide to Retirement Planning

Learn more

Make your money matter.

I believe everyone is entitled to feel confident about their financial future. Most schools do not educate us for financial success and there may not be significant guidance growing up around money, so it often becomes something people try to figure out on their own.

What if I told you that you have a resource available to you? A team who wants to help educate you, who wants to understand not only what assets you have, but what your relationship with your finances is like? Anyone can manage your money, but finding someone who wants to understand what's important to you in life, help you protect what matters most and cheer you on as you crush goals you may have never thought were possible, is priceless. Understanding your fears and what keeps you up at night is crucial to building a tailored plan designed specifically for you.

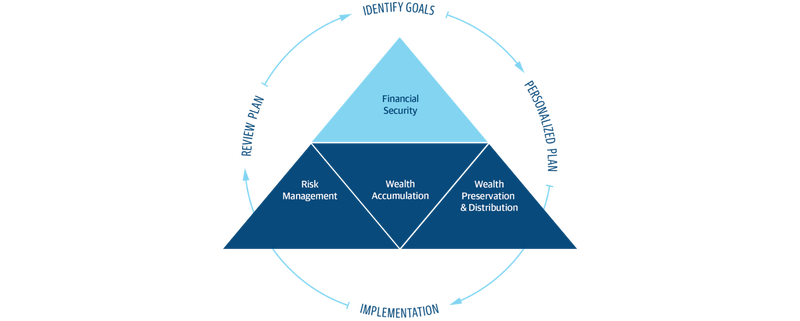

With a fiduciary responsibility in advisory relationships, I only recommend strategies that fit into your plan and align with your short and long-term goals. I guide my clients with a road map that shows us where you are versus where you want to be.

I'll guide you through each step so you'll feel confident that you can do the things you've always wanted to—without having to worry if you can. See how we'll get it done below:

Your plan will help you make the most of what you already have, no matter where you're starting from, and give you a snapshot of your financial big picture.

Whether it's shorter-term goals like managing your debt, or longer-term ones like saving for a new home, or retirement, your financial plan will show you how you're tracking, help you understand what's working, and point out any gaps you might have.

Looking across all your goals, you'll get personalized recommendations and strategies to grow your wealth while making sure everything's protected. And I'll help you determine the right moves to make today and later on. Your financial plan is based on your priorities. As those priorities change throughout your life, we'll shift the financial strategies in your plan, too-so your plan stays flexible, and you stay on track to consistently meet goal after goal.

Financial Planning

Life Insurance Strategies

Disability Planning

Insurance Protection Strategies

Retirement Planning & Income Strategies

Education Planning & Funding

Tax-Efficient Strategies

Business Planning

Best life insurance company for consumer experience, 2023. (NerdWallet)1

We're one of the Top U.S. Independent Investment Broker-Dealers.2

In dividends expected to be paid in 2025.3

AAA, Aaa, and AA+ - we've earned the highest financial strength ratings awarded to life insurers from all four major rating agencies.4