article

Tariffs Add Another Challenge for Investors to Consider

Learn more

Maximize the Moments.

Our in-house team and network of national affiliates combine decades of industry experience with a diverse set of skills to ensure we serve you in a manner that reflects your intentions, input, and needs. You can count on us to go the extra mile and make your life easier every step of the way.

Our comprehensive approach focuses on seven interconnected components, all of which provide a clear understanding of what's happening with your finances and are vital to a complete financial blueprint. This approach allows our clients to have the best experience in every area from one cohesive source.

We deliver the security and peace of mind that comes from knowing your finances are being expertly cared for and thoughtfully managed. You can move toward the future with confidence knowing you have a partner looking out for your best interests through every season of life.

We help you assess the big picture and prioritize your financial to-do list so you can make continual progress toward your goals. We'll help design a comprehensive plan for your journey that accounts for your needs and goals both now and in the future.

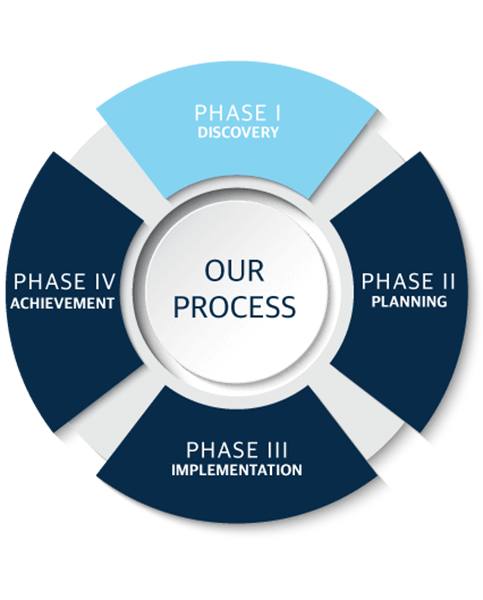

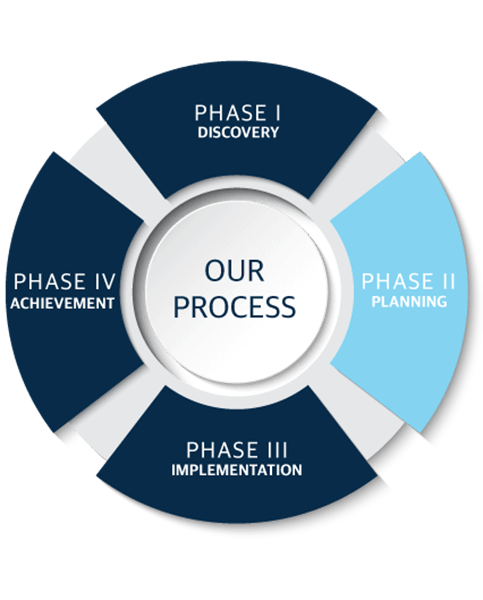

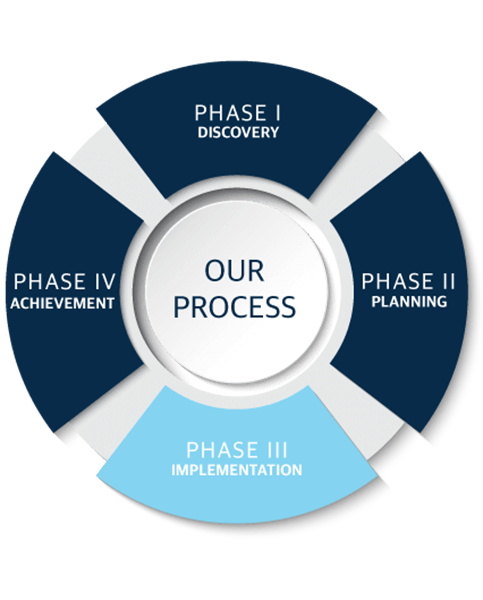

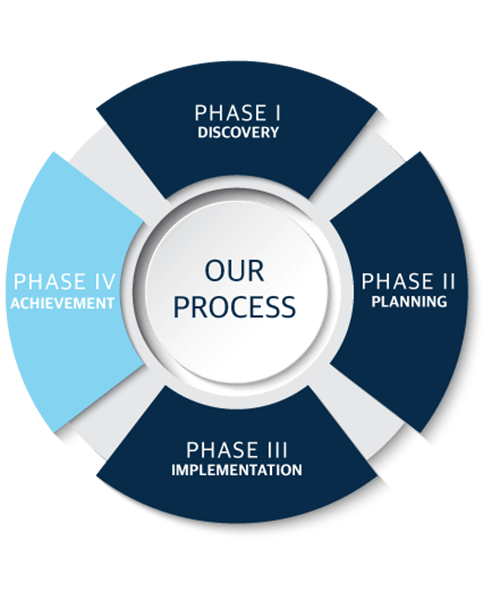

Our process begins with a period of discovery where we’ll explore your dreams and goals. We want to know what legacy you hope to leave and what keeps you up at night so that we can craft a financial plan that’s unique to your needs.

Next we’ll work closely with you to create a financial blueprint tailored to your goals. It will serve as a roadmap for your financial journey, equipping you with the information you need to make wise financial decisions with confidence.

Once the plan is developed, we’ll work with you to implement it, focusing on the highest impact moves first. We’ll coordinate with any existing members of your team, such as your CPA or attorney, and we’ll make introductions to other strategic professionals as needed.

With your plan actively in place, you’ll move forward with clarity about where you are and where you’re going. You’ll experience greater peace of mind, knowing you have a trusted partner helping you maximize and preserve your wealth through every season of life.

PERSONALIZED PLANNING, WORLD-CLASS SUPPORT. We Are Award Winning

Justin Wong Won has been recognized by Forbes as one of the top financial security professionals in Connecticut. Many thanks to our hardworking team, amazing clients, and partnership with Northwestern Mutual. This would not have been possible without you.

Disclosure: Forbes Top Financial Security Professionals list (July 2024), Research and ranking provided by SHOOK Research, LLC. Based upon data as of 12/31/2023. Northwestern Mutual (NM) and its advisors do not pay for placement on 3rd party rating or ranking lists. NM and its advisors do, however, pay marketing fees to these organizations to promote the rating or ranking(s). Rankings and recognitions are no guarantee of future investment success.

|

|

We have built our team, and expertise, to meet the needs of the ascending affluent. Our core clientele are medical trained professionals. As such, our clients tend to have a high financial acumen, are building substantial net worth, and living exceedingly busy lives serving others. The result for many of our clients is that the highest return on their time is in their business, with any additional time spent living enriching lives with their families. This dynamic often creates friction when it comes to managing the substantial net worth they are building. Any time spent slowing down, researching, and deploying new strategies, or just generally managing their wealth can become difficult and can often lead to inaction, or worse, inefficiency. This is where our team steps in. We sit alongside our clients as a thought partner to not only bring new ideas and strategies to the table, but also to help provide the expertise and experience to implement and maintain these strategies as well.

One pain point all of our clients share is taxes. While we believe taxes are necessary to the operation of society, we do not believe our clients should leave a “tip” on top. As such we have built our team to look at strategies through the lens of taxation and find ways to create efficiencies at every turn. Whether that is taxes today, tomorrow, or when you pass along your estate to heirs or charity, our team is constantly helping to ensure our clients are as educated and efficient as possible.

Financial Representatives do not render tax advice. Consult with a tax professional for tax advice that is specific to your situation.

Access a timely summary of market happenings and economic indicators, plus get a glimpse of what's to come in Northwestern Mutual's Weekly Market Commentary. Find a timely summary and insightful commentary on economic and financial market trends in our Quarterly Market Commentary. Topics include:

Best life insurance company for consumer experience, 2023. (NerdWallet)1

We're one of the Top U.S. Independent Investment Broker-Dealers.2

In dividends expected to be paid in 2025.3

AAA, Aaa, and AA+ - we've earned the highest financial strength ratings awarded to life insurers from all four major rating agencies.4