Small World Wealth Management

Jeffrey S Vitelkites

Wealth Management Advisor|RICP®, QPFC, CLU®, ChFC®

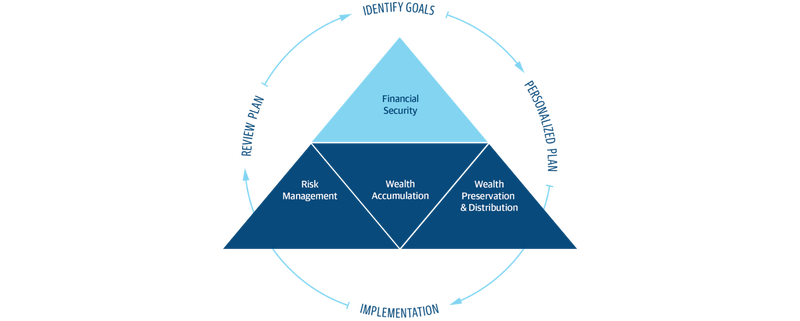

Our Planning Process

We'll guide you through our four step process so you'll feel confident that you can do the things you've always wanted to—without having to worry if you can. See how we'll get it done below:

Identify Goals

We'll spend ample time learning who you are, and what your goals are in order to start the plan creation.

Personalized Plan

Taking your goals, we'll create a planning document that takes you from now to retirement and well beyond.

Implementation

We'll sit down and go through the plan to determine which strategies to implement and when, based on your preferences and timeline.

Review Plan

Once you've begun the plan, we want to make sure to meet at least once a year, or more, to insure that as your life changes your plan changes with it.

Financial planning

Our financial planning conversations don't begin with your finances. Instead we start with you - your life, your family, your priorities, and goals. Once we have your big picture in focus, we'll tailor a plan from a range of financial options using multiple strategies designed specifically to help get you to where you want to be.

Retirement planning

We tailor your plan to fit you and your goals with a range of financial options. From insurance for protection to strategies for growing your money and providing more flexibility, we'll help you live the retirement you always wanted.

Education funding

With the cost of school continuing to rise, it's more important than ever to have a plan to pay for it. From strategies for saving and funding education to how whole life insurance can play a role, we can help you understand your options.

Business planning

No matter if your business is big or small, we'll work hard to help you grow. From protecting against risk and managing growth, to attracting and retaining top talent, we have a range of solutions designed for you and your employees.

Estate planning

We can help you coordinate with your other advisors like attorneys, accountants, and tax professionals to do things like set up trusts, minimize taxes, and administrative costs that can protect the legacy you leave behind.