Buffum Wealth Management

Jeff Buffum

Wealth Management Advisor|CFP®, ChFC®

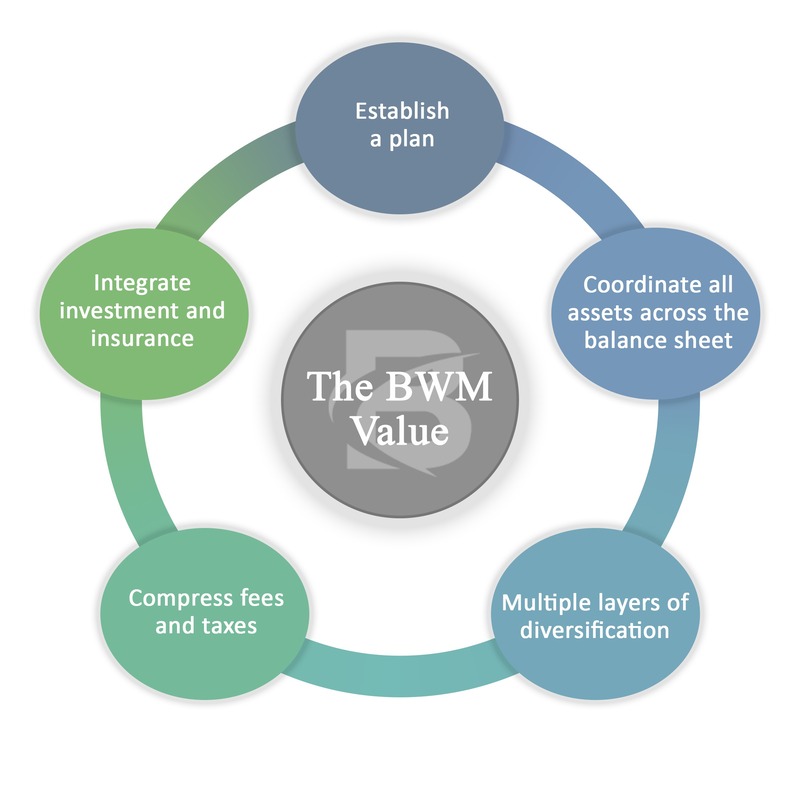

Our Proven Approach

1. Establish a plan

- Establish personalized, time-bound goals and measure progress, including knowing the rate of return needed to achieve your goals

- Have a planned approach to market events, meaning not to panic during down markets and therefore utilize them as an opportunity

- Maintain short-term cash reserves and build retirement reserves for future emergencies and opportunities

- Establish a strategic asset allocation and make targeted investments

- Plan for liquidity needs and retirement income distribution

2. Coordinate all assets across the balance sheet

- All assets play a specific role to maximize tax-adjusted returns and income

- Your strategic financial planning is coordinated and holistic

- Integrates Risk Management, Wealth Accumulation and Wealth Distribution strategies

3. Multiple layers of diversification

- Risk: Aggressive vs. Conservative

- Tax: Taxable, Tax-deferred, Tax-free

- Liquidity: Liquid vs. Illiquid

- Geography: US vs. International

- Company Size: Large, Mid, Small

- Style: Growth vs. Value

- Strategy: Active vs. Passive

4. Cost conscious, tax-efficient strategies

- Examine unnecessary costs and taxes

- Increase efficiency

- Tax diversification, asset location and tax-loss harvesting

- Enhance after-tax returns

5. Integrate investment and insurance products

- Utilize the most efficient products across the market

- Increase yield

- Reduce taxes

- Increase retirement income

- Increase legacy

Financial Representatives do not render tax advice. Consult with a tax professional for tax advice that is specific to your situation.

Designations

Through my dedication to continued learning to better serve my clients, I currently have the following designations:

Certified Financial Planner® professional

The CFP® certification has become the recognized standard of excellence for personal financial planning. Rigorous testing in a wide range of topic areas, experience requirements and strict ongoing ethical conduct are necessary to obtain and hold the CFP® certification mark.

ChFC® Chartered Financial Consultant

The Chartered Financial Consultant (ChFC®) designation promotes expertise in advanced financial planning topics relating to needs of individuals, professionals and small-business owners. This expertise spans planning disciplines including insurance, income taxation, retirement planning, investments and estate planning.

Forbes Best-in-State Top Financial Security Professional

Recently Jeff Buffum was recognized as a Forbes Top Financial Security Professional, coming in at #42 in the NYC area in the 2024 Best-in-State list.

Forbes Best-in-State Top Financial Security Professionals list (July 2024), Research and ranking provided by SHOOK Research, LLC. Based upon data as of 12/31/2023. Northwestern Mutual (NM) and its advisors do not pay for placement on 3rd party rating or ranking lists. NM and its advisors do, however, pay marketing fees to these organizations to promote the rating or ranking(s). Rankings and recognitions are no guarantee of future investment success.

Million Dollar Round Table - Top 10% in the industry, 2013-2024

MDRT is the premier association of financial professionals. MDRT status designation is granted for one year and members must apply every year to continue their affiliation with the MDRT.

In 2021 our team achieved "Top of the Table" status - which includes the Top 1% in the industry - and every year thereafter.

Forum - Top 5% in the company nationwide

Forum is Northwestern Mutual's prestigious honor bestowed to only the top 5% of Financial Advisors nationally, as the highest level of excellence in their profession. Our team has achieved Forum status every year since 2018.

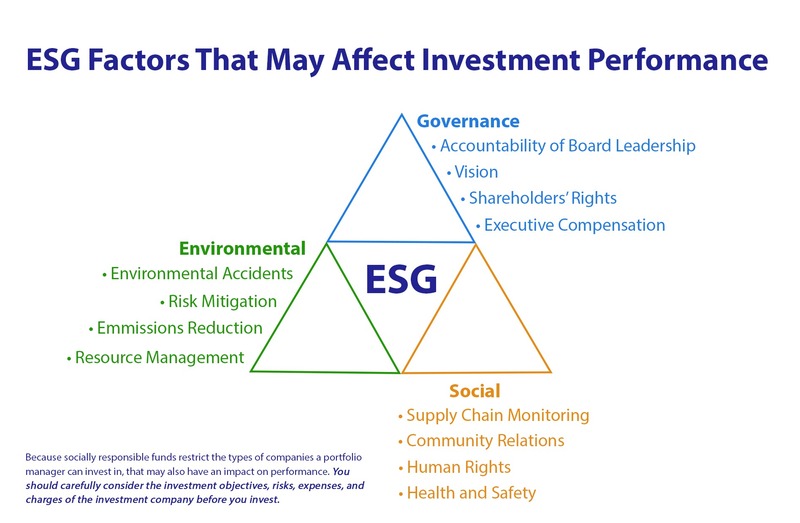

Socially Responsible Investing

There's no need to feel torn between your beliefs and your financial future. Buffum Wealth Management offers Socially Responsible Portfolios which focus on Environmental, Social, and Governance, i.e., ESG, factors.

Socially responsible investing (SRI) is an investment philosophy that seeks a financial return while also focusing on environmental, social, and governance issues.

The main strategy of SRI is to identify companies that are both attractive investments and are focused on positive impact for the good of humanity. This investment approach evaluates a company's financial standing along with the underlying environmental, social, and governance impacts of its operations. For example, companies that reduce pollution, use green energy, offer a good working environment, promote diversity within the workplace, or sponsor community development receive higher Environmental, Social, and Governance (ESG) ratings than companies that do not.