article

5 Times You’ll Be Able to Teach Your Kids About Money Management

Learn more

Through our integrated holistic planning process, our team will guide you through each step so you'll feel confident about your goals and priorities. We will make sure that you are able to do the things you've always wanted to do.

See how we'll get it done below:

Your plan will help you make the most of what you already have, no matter where you're starting from, and give you a snapshot of your financial big picture.

Whether it's shorter-term goals like managing your debt, or longer-term ones like saving for a new home, or retirement, your financial plan will show you how you're tracking, help you understand what's working, and point out any gaps you might have.

Looking across all your goals, you'll get personalized recommendations and strategies to grow your wealth while making sure everything's protected. And I'll help you determine the right moves to make today and later on. Your financial plan is based on your priorities. As those priorities change throughout your life, we'll shift the financial strategies in your plan, too-so your plan stays flexible, and you stay on track to consistently meet goal after goal.

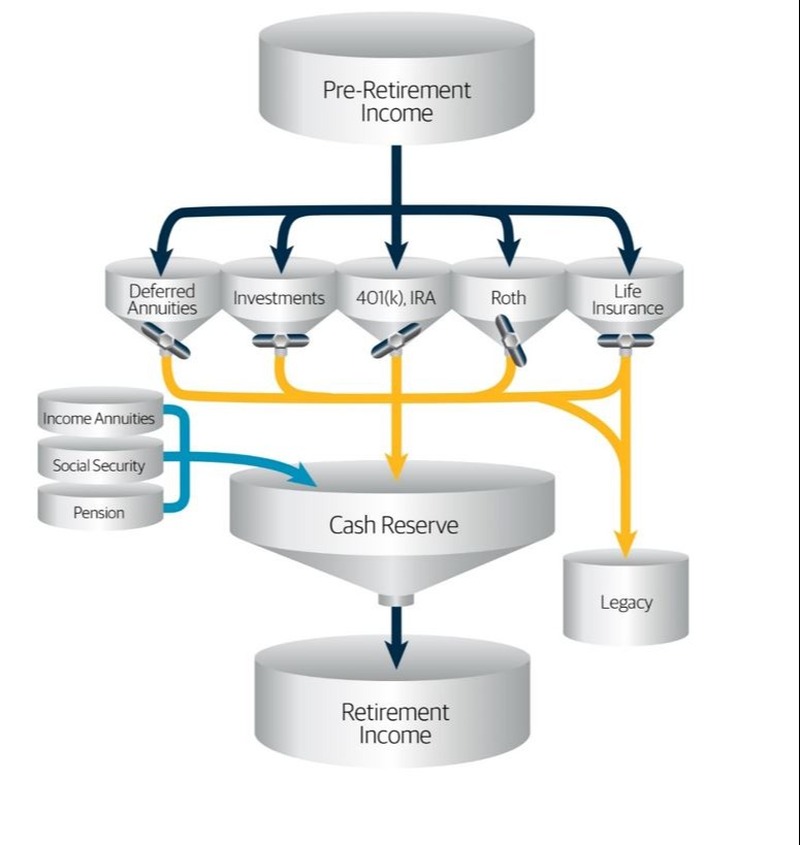

We believe in optionality when it comes to diversifying retirement savings. The three biggest risks when it comes to planning for retirement income are longevity risk, market risk and taxes.

Having options while you are accumulating retirement assets, and when you are distributing assets, will create balance and mitigate those risks in the most efficient way. Your retirement income plan should quantify your needs, identify your sources of income, allocate your assets appropriately and help guard against outliving those assets.

We’ll also help you understand the options available to you for Social Security and Medicare and how they will impact your retirement income plan.

The primary purpose of permanent life insurance is to provide a death benefit. Using permanent life insurance accumulated value to supplement retirement income will reduce the death benefit and may affect other aspects of the policy.

Best life insurance company for consumer experience, 2023. (NerdWallet)1

We're one of the Top U.S. Independent Investment Broker-Dealers.2

In dividends expected to be paid in 2025.3

AAA, Aaa, and AA+ - we've earned the highest financial strength ratings awarded to life insurers from all four major rating agencies.4