article

5 Times You’ll Be Able to Teach Your Kids About Money Management

Learn more

At my financial planning practice, I'm all about empowering you with the knowledge and tools to build a secure, stress-free future. I get that financial literacy isn't something most of us learned growing up, which can make big money decisions pretty daunting. That’s why I’m here to offer clear, actionable advice to help you with saving, investing, and insurance.

My goal is to be your go-to resource, guiding you towards financial freedom and peace of mind. Everyone deserves to live without financial worries, and I’m dedicated to making that happen for you. Whether you’re an entrepreneur, blue-collar worker, pink-collar worker, or planning for retirement, I tailor my approach to fit your unique needs.

Integrity, loyalty, and trust are my guiding values. I’m all about being transparent, reliable, and straight-up honest with you. My aim is to help you feel secure in your financial choices and confident about the future. By managing fixed expenses, making the most of your income, and setting up a solid emergency fund, I help you prepare for life's unexpected twists.

I’m also here to support your long-term goals, whether it’s buying a home, funding education, starting a business, retiring comfortably, or leaving a legacy. With a focus on financial education and personalized guidance, I make sure you get the attention and expertise you need to achieve your dreams. Let’s team up and make your financial goals a reality!

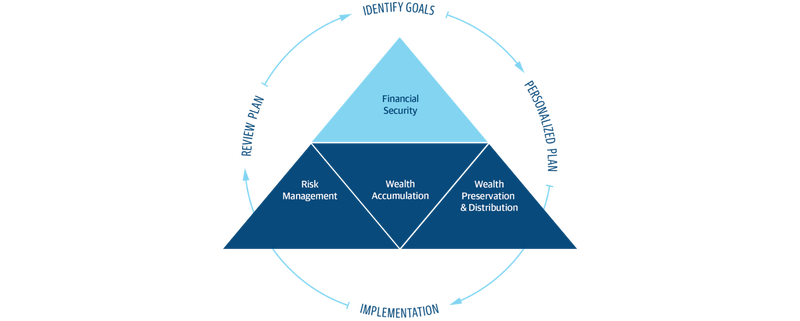

I'll guide you through each step so you'll feel confident that you can do the things you've always wanted to—without having to worry if you can. See how we'll get it done below:

Your plan will help you make the most of what you already have, no matter where you're starting from, and give you a snapshot of your financial big picture.

Whether it's shorter-term goals like managing your debt, or longer-term ones like saving for a new home, or retirement, your financial plan will show you how you're tracking, help you understand what's working, and point out any gaps you might have.

Looking across all your goals, you'll get personalized recommendations and strategies to grow your wealth while making sure everything's protected. And I'll help you determine the right moves to make today and later on. Your financial plan is based on your priorities. As those priorities change throughout your life, we'll shift the financial strategies in your plan, too-so your plan stays flexible, and you stay on track to consistently meet goal after goal.

Financial Planning

Tax-Efficient Strategies

Insurance Protection Strategies

Life Insurance Strategies

Education Planning & Funding

Disability Planning

Multigenerational Planning

Best life insurance company for consumer experience, 2023. (NerdWallet)1

We're one of the Top U.S. Independent Investment Broker-Dealers.2

In dividends expected to be paid in 2025.3

AAA, Aaa, and AA+ - we've earned the highest financial strength ratings awarded to life insurers from all four major rating agencies.4