Alexander Peterson

Financial Advisor|RICP®, ChFC®

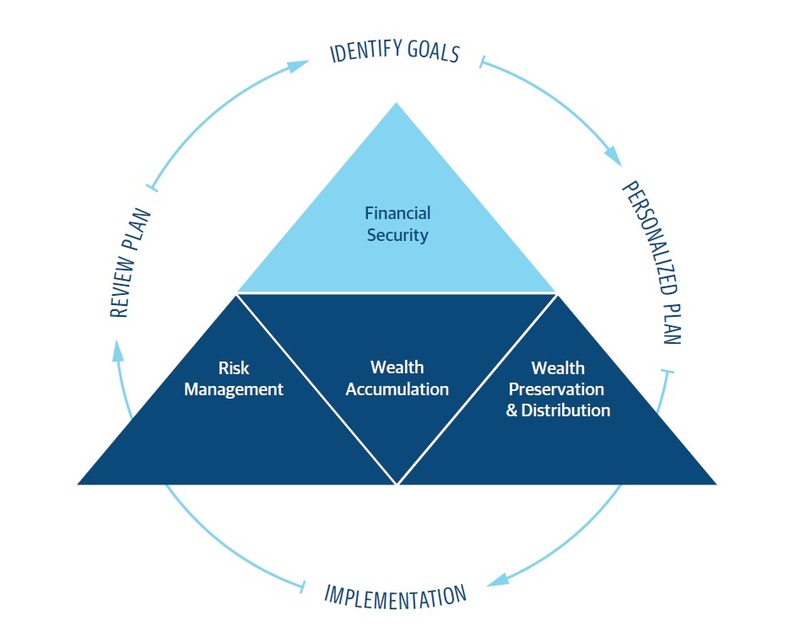

Whether you’re just starting out, well on your way to living your dream or eagerly approaching retirement, make sure you’re financially prepared to achieve a lifetime of goals. We can help you reach them with a personalized financial plan.

Our team will apply time-tested strategies, providing education and expert advice to help you make decisions based on your priorities. As your circumstances and priorities change over time, we’ll work with you to revise your plan so you can meet each of life’s challenges head on and celebrate your accomplishments along the way.

Here are my areas of expertise

Investment Planning & Strategies

Retirement Planning & Income Strategies

Tax-Efficient Strategies

Education Planning & Funding

Business Employee & Executive Benefits Planning

Insurance Protection Strategies

Investments: invest in your best life.

With more ways to invest than ever before, it can be hard to make sure your money is working its hardest for you. We focus on long-term investment strategies to give you more confidence and help make sure that the growth potential and management of your money isn't left to chance.

Retirement solutions: have the additional income you want.

With fewer companies offering pensions and the future of Social Security uncertain, it's more important than ever to have a comprehensive plan. We have a range of options to help you enjoy every day of your retirement years.

Life insurance: protect you and your loved ones.

You've worked hard to build a life you enjoy with the people you love, let's make sure you protect it. We'll work together to figure out how life insurance can meet your needs. Here are a range of options you can consider to fit your needs:

Disability income: protection for your earning power.

Your ability to earn a living is likely the most important financial asset you have. Depending on the type of job you have (or business you own), we have a solution.

Long-term care: have more choice and control.

How Northwestern Mutual helps you live the life you want.

When people feel better about their money, good things happen—they become more confident and feel more secure. For more than 160 years, Northwestern Mutual has helped people achieve the financial flexibility they need to live more and worry less.

Being a mutual company means Northwestern Mutual reports to its clients, not Wall Street. They don't believe in chasing fads or taking undue risk for short-term gains. Instead, they take a long-term approach—both in the way we help people plan to reach their goals, and in the way they do business. This has served their clients (and mine) well through all kinds of economic ups and downs, including wars, recessions, even the recent pandemic.

It's why I'm happy to be part of a company that's in it for the long-haul and prioritizes clients over profit.