Americans today seem to be at odds with themselves when it comes to their feelings on economic growth. People are worried about a future lack of economic growth due to a less productive workforce. Oddly, many of those same people are also worried that robots, automation and artificial intelligence will displace human workers. It’s ironic because these two outcomes could actually work together to the benefit of the economy and those of us who invest in it.

This forum is much too small to cover this complex topic in its entirety, but I want to take a brief stab at some key points.

Nobel Prize-winning economist Paul Krugman once said, “Productivity isn’t everything, but in the long run it is almost everything.” What does this mean? While we fixate on the formula for short-term economic growth, which is C (consumption) + I (investment) + G (government) + NX (net exports), the recipe for long-term potential growth (wealth/living standards) is much simpler: how many people work and how productive or efficient they are.

We’ve all heard about declining demographics in many countries around the globe. Lower birth rates and aging populations form the fears that we will see less economic growth in the future. In our long-term economic growth formula above, this represents the number of people who work. If we have fewer individuals contributing to our overall economic growth in the future, an increase in individual productivity becomes incredibly important to our well-being.

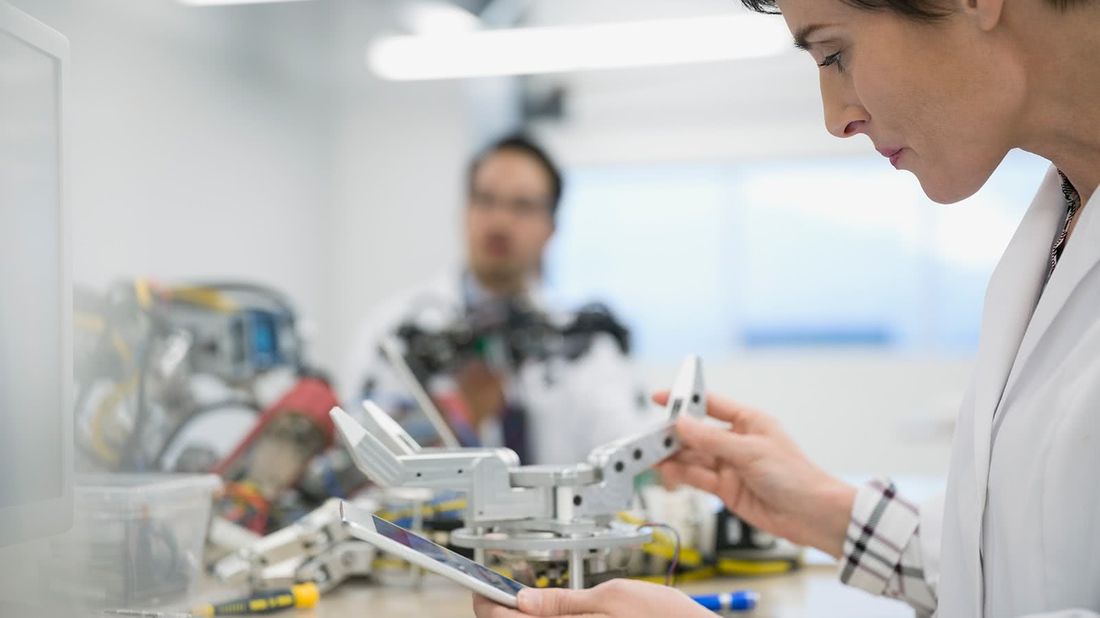

Let’s use a real-life example to put this concept into context. Japan and many countries in Europe have the potential for declining labor forces. There are fewer and fewer humans to produce the levels of output that we currently enjoy. Might robots fill the gap left by fewer humans working, and could they also enhance the output (productivity) of the humans who want to continue working? Indeed, robots in Japan are currently being used to help aging workers remain productive contributors to economic growth. Panasonic, for example, has revealed robotic exoskeletons that help aging humans in a variety of fields lift heavy objects. And this is just one instance in which artificial intelligence is actually contributing to humans’ productivity.

IS THE ‘AUTOMATION UNCERTAINTY’ DIFFERENT THAN IN THE PAST?

I imagine many people agree with the above analysis yet remain worried about the magnitude of lost jobs due to technological improvements. Data on the subject is mixed, and only time will reveal how many people lose their jobs to technology. However, as with many things in life, people often fixate on only one side of the equation — jobs lost — while ignoring the possibility of new jobs created.

I often shape my thoughts by contemplating “what if” extremes. What if I was appointed economic czar and was tasked with providing the best chance that every able-bodied American would have a job? I think this could be accomplished by ridding the U.S. of heavy industrial and farm equipment. In my “what if” scenario I would get rid of all combines, tractors and road bulldozers. By necessity, I’d surmise, we would all need to go back to building roads and manually planting and harvesting crops as a way of life. Everyone would have a job, but we’d clearly take huge steps backward when it comes to standard of living.

Panasonic, for example, has revealed robotic exoskeletons that help aging humans in a variety of fields lift heavy objects. And this is just one instance in which artificial intelligence is actually contributing to humans’ productivity.

I imagine if we were sitting in a room decades ago as farmers, we would rightfully be worried about our future employment. However, as the world evolved, new jobs were created in industries we never would have fathomed would exist. Those who would otherwise have been farmers were now free to innovate and create new industries. While it seems like forever, it was actually just a few years ago that the Apple iPhone was introduced and the personal device/cellphone market as we know it today was created. As it blossomed, the app industry was hatched, and with it, more than a million jobs that didn’t previously exist were opened. Today it’s an $88 billion industry. While I acknowledge that we will likely need many “app markets” in the future to open new jobs, I’m confident in the process of innovation that envelops the U.S. economy.

DEALING WITH UNCERTAINTY

Like any time over the past hundreds of years, the future remains a very uncertain beast. Many jobs will be automated and eliminated. But in their place new jobs will likely be created, and our standard of living will continue increasing from the resulting innovation. This is why we now have TVs, smartphones and computers. It’s why we enjoy relatively better living standards than those of the past. For the average investor, continued innovation could mean great opportunity.

I don’t make light of that fact that much as in the past, the shorter-term costs of job losses will fall disproportionately upon certain segments of the population. But that’s no reason to throttle innovations like artificial intelligence. Rather, policy makers and others need to figure out how to care for and retrain displaced workers in the shorter term — this will ultimately position them for intermediate- to longer-term success.

Even I worry that my job could one day fall prey to artificial intelligence. Perhaps a robot could write a better article. It’s an uncomfortable thought at my age that I may have to find new employment in the future, but I intend to deal with that by focusing on what I can control: continuous learning; improving and building my overall skill set; and most importantly, continued saving, investing and planning so I’m prepared for whatever the future may hold.

Northwestern Mutual is the marketing name for The Northwestern Mutual Life Insurance Company, Milwaukee, WI (NM) (life and disability insurance, annuities, and life insurance with long-term care benefits) and its subsidiaries. Northwestern Mutual Investment Services, LLC (securities), subsidiary of NM, broker-dealer, registered investment adviser, member FINRA and SIPC. Northwestern Mutual Wealth Management Company® (NMWMC), Milwaukee, WI (fiduciary and fee-based financial planning services), subsidiary of NM, limited purpose federal savings bank.

This publication is not intended as legal or tax advice. Financial representatives do not give legal or tax advice. Taxpayers should seek advice based on their particular circumstances from an independent tax advisor.

The opinions expressed are those of Northwestern Mutual as of the date stated on this publication and are subject to change. There is no guarantee that any forecasts made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment or security. Information and opinions are derived from proprietary and non-proprietary sources. Sources may include Bloomberg, Morningstar, FactSet and Standard & Poor’s.

Please remember that all investments carry some level of risk, including the potential loss of principal invested. Returns represent past performance, are not a guarantee of future performance and are not indicative of any specific investment. Diversification and strategic asset allocation do not assure profit or protect against loss. Although stocks have historically outperformed bonds, they also have historically been more volatile. Investors should carefully consider their ability to invest during volatile periods in the market.

Feel better about taking action on your dreams.

Your advisor will get to know what’s important to you now and years from now. They can help you personalize a comprehensive plan that gives you the confidence that you’re taking the right steps.

Find your advisor